NO DEAL PLANNING and ADVICE

GET AN EORI NUMBER https://www.gov.uk/eori

Following the advice from UK Government and heavy media coverage, the number of companies applying for EORI numbers has increased significantly. However, please do not think it is the answer to everything. Having an EORI number is the first step in the journey, not the last. We receive many calls saying “we are ready, we have our EORI number!”. Well done but this is only for basic import/export documentation and does not plug-in to the simplifications designed to keep things moving post Brexit. You should also evaluate the benefits of CFSP and AEO approval, even if you then chose to discount them. Our latest Brexit & Customs plan is attached and has been updated with the most up-to-date processes and procedures aimed at making the movement of goods as frictionless as possible. We would urge you to read the attached. We are, of course, on hand should you require advice or assistance in obtaining these accreditations.

THE WRONG EORI NUMBER!

Let’s be very clear here: if you import goods in to the UK (or export from UK), you need a UK EORI number. Not a French one, not a German one but absolutely 100% a UK one. Having an EORI number in another EU member state will not help with UK import documentation if you are the UK importer. It is not valid for this purpose. As part of the Government Partnership Pack for NO DEAL planning they produced, amongst hundreds of pages, two excellent poster size guides. Print these and keep them handy. Contact us if anything is unclear as we are extremely familiar with the processes outlined in these two documents. They can be found here:-

IMPORTS

EXPORTS

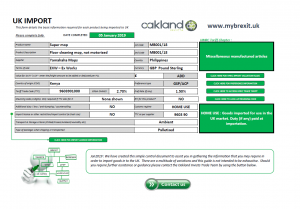

CLASSIFYING YOUR GOODS

You will have been advised to classify your goods in readiness for Brexit. This is often referred to as the HS code, the commodity number, TTC or simply the tariff number. It is a Customs code number relevant (or most relevant) to your goods. The basic rule of thumb when ascertaining the correct TTC is (1) what is it? (2) what does it do? and (3) what is it made of? By answering these three questions you should be able to identify the most appropriate TTC. Be careful, if import duties or restrictions apply they will be associated with the code you have identified. It is vital that you get the code right. We have created a handy tool to help you control the number and identify what rates of duty, additional controls, licencing or restrictions apply (if any). See the attachment entitled TTC. Note that for imports the TTC is 10 digits (14 if Measuring codes apply) and for exports it is just 8 (the first 8). Should you be unable to identify the correct code we can assist you. In some cases it may be necessary to apply for a BTI (Binding Tariff ruling) to avoid future problems or calls for retrospective duties.

SAFETY AND SECURITY DECLARATION

This is a little-known complication created by Brexit. It is NOT a Customs entry but an additional declaration required BEFORE the goods are presented at the import border (whether that border is in UK for imports or EU for exports). The declaration must be electronically presented at least 2 hours before the vehicle arrives at the frontier. Failure to do so could delay the vehicle on arrival, even if the Customs import declaration is already in place. This is a serious matter and needs to be carefully considered to avoid delays. In most cases it is the responsibility of the haulier to present this declaration (or the ferry company in the case of unaccompanied trailer shipments). Make sure you or your haulier is aware of the requirements and able to present these declarations en-route. As you would expect, we have drawn up a guide to cover this topic and attach it here. For your information, we are currently installing the necessary software and connections to allow us to present these declarations should you so wish.

DO I NEED TO STOCK-PILE?

Ah, the most common question at the moment. UK import processes are likely to be pretty smooth although as we always say “we can get you through the border quickly, but we can’t get you to the border!” Much of the so-called friction will be caused by the under prepared. There are 145,000 UK traders being exposed to Customs formalities for the first time. We are talking to many of them, but far from all of them! There will be a proportion of the market that has failed to prepare (it is normal) and these may create some delays in the initial period of adjustment. Our bigger concern is the flow of exports from the UK. These have far more potential for delay and whilst this might not immediately affect UK imports, it may eventually. 85% of the trucks bringing goods in to the UK are foreign. If they struggle to get back out (of the UK) they may be less enthusiastic about returning. It is important to discuss this with your transport provider to investigate alternative exit routes as Dover may be the worst affected in the initial stages. Mainly for this reason we advocate some level of stock-piling. We can offer ambient, chilled and frozen storage but demand is high and we would encourage you to have these conversations sooner rather than later.

e-PING ALERTS

We’ve recently signed up for e-Ping alerts and thought we would inform you of this service particularly as WTO may soon become a way of life. E-Ping is run by the World Trade Organisation and allows you to create alerts for the type of products that matter to you. Once you have established the parameters e-Ping will send you a note when there are any new rules/laws concerning the trade in your goods. It was hard enough to keep up with EU rules and regulations in the past, we might now have to keep up with WTO as well. This handy tool should help. Registration is free and will not take too much of your time. http://www.epingalert.org/en

As ever, please excuse any typing errors in this content. We are more worried about the message than the presentation. Further updates will follow to include:-

1. Export paperwork – what is a EAD and why do I need one?

2. Brexit policy statements

3. Customer FAQ’s: we’ve taken the most regular questions and drawn up our responses

4. Goods in transit (including to/from Ireland)

5. CHIEF and the (delayed) upgrade to CDS (Customs Declaration Service)

6. How do I do a CFSP return?

Robert Hardy, Commercial Director, Oakland International