EORI NUMBERS FOR ALL

EORI, or Economic Operator Registration and Identification to give it its full name, is (in most cases) your VAT number with some additional data fields. It should not be confused with AEO (Authorised Economic Operator). Unlike AEO, EORI is quick and easy to obtain. It is, however, vital in a NO DEAL scenario. The exporter needs an EORI number and so too does the importer. If you are a UK importer (see below) you MUST have a UK EORI number. In some cases that will mean registering for VAT in the UK – you do not need to form a company but you do need a UK VAT (and EORI) if you are the UK importer. This information is fairly well known, however what is little known is that the haulier must also have an EORI number. In general terms the haulier does not normally need an EORI but in NO DEAL Brexit each vehicle that leaves or enters the UK will be required to submit a Safety & Security declaration. The exact process will be notified before March 29th but for sure the company that presents the S&S declaration MUST have an EORI number.

EORI is quick and easy to arrange. In the UK the link is : https://www.gov.uk/eori

WHO IS THE UK IMPORTER?

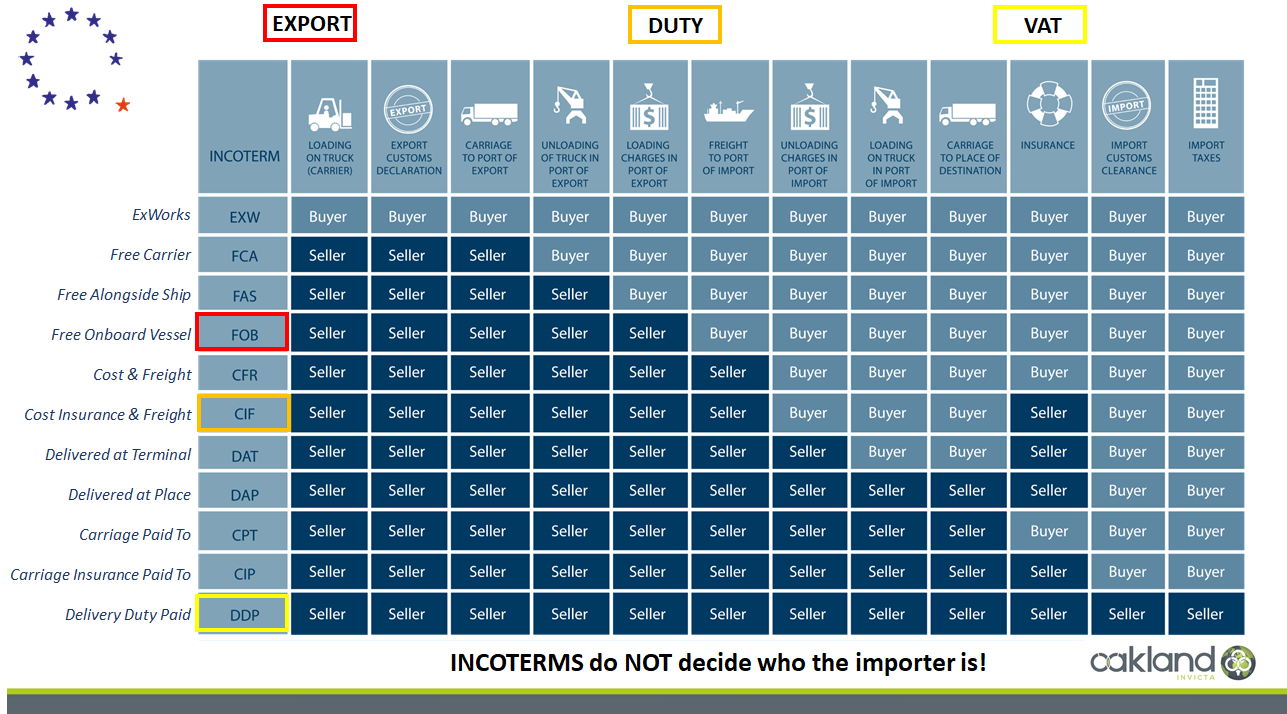

This is not always as obvious as it might sound. I have had some telling me “I’m not the importer as I buy on a FREE DELIVERED basis”. This is not relevant. Incoterms do not decide who the importer is but they are vital in arriving at the Customs value. Incoterms (see below) also clearly define who pays for what. So, back to the importer question. Take for example: you are a German sausage producer and you send product to the UK (to be stored at Oakland for example) and those goods are then ordered by the retailer, picked and despatched. In this case the German sausage producer is the UK importer and will need to register for VAT in the UK (and get an EORI number). How come? When the goods were shipped from DE to UK the retailer had not ordered them (and might not ever order them). The movement of goods in this case was the movement of forecasted stock. A good ‘rule of thumb’ is to ask yourself “who caused the goods to cross the border?” – in many cases the answer to this question will identify who the UK importer is.

INCOTERMS

For those involved in world-wide shipments, Incoterms will be nothing new. However, there are 150,000+ companies who will be using Incoterms for the first time. You will need to understand their significance. For intra-EU trade we have all become a bit lazy and simply use terms such as Ex Works or Delivered. Post Brexit (whatever shape that finally takes), we will need to be a little more scientific. Let’s take each example :-

EX WORKS (EXW) : This will mean that your customer collects and pays for everything. He will also arrange (and pay for) the export documentation. This can cause problems as you will be exporting goods as zero rated for VAT (see below) and will need to prove (to your VAT man) that the goods have left the territory otherwise you may be required to pay the VAT. You might want to cover this off with your client. By all means continue with Ex Works but make sure you get a copy of the export document so you can discharge your VAT liability.

DELIVERED (DAP) : Sorry but there is no such thing in Incoterms. The reason why this does not exist is that it fails to cover the import duty and Customs declaration costs. You might want to consider DAP as a more appropriate term. See attached chart. Whichever term you decide you will need to start including it in contracts, orders and invoices. It is important to clearly define who pays for what and that is precisely why Incoterms exist.

DELIVERED DUTY PAID (DDP) : worth noting that if you intend to accept the import duty and Customs charges this will NOT include import VAT at destination. VAT is always paid (or accounted for) by the importer, regardless of Incoterms.

As mentioned, Incoterms are used to arrive at the Customs value:-

FOB = value for export declaration

CIF = Value for import duty

DDP = Value for import VAT

ZERO RATED EXPORTS

The significant change that removed EU Customs paperwork 25 years ago was the centralisation of VAT. What we see as ‘reverse charge’ today meant that EU Customs declarations were no longer required (and intrastat was born). As many of you will know, if you currently send goods from A in UK to B in France (for example), you do not charge VAT but merely state the VAT number of Company B on the Company A invoice. Post Brexit this will change. Company A will export goods as zero rated and Company B will account for VAT in the destination country. A will be required to arrange an export declaration and control that document in order to discharge their VAT liability and B will be required to submit an import declaration to account for the VAT in his country. No matter which shape Brexit finally takes this is unlikely to change.

I could go on for pages but I want to keep these updates relatively short and frequent. Future updates will cover :-

1. Duty on imports

2. Export paperwork – what is an EAD?

3. Customs simplifications (particularly CFSP)

4. Do I need to stock-pile?

5. Delays on exports (or trucks returning)

6. Brexit policy statements

I hope these updates will be useful to you. If there are some specific issues you would like covered please feel free to ask. Please bear in mind that our speciality are Customs, tariffs, trade and borders; we have a view on such things foreign exchange and labour but better to stick to what we know best.

Robert Hardy, Commercial Director, Oakland International